In order to get a bigger share of the market. Optical transceiver vendors are challenged in how to differentiate their optical transceiver design and give the products conform to common form factors. To understand the importance of transceiver differentiation, it is worth reviewing the purpose of multi-source agreement (MSA) transceiver form factors.

Common form factors arose so that optical equipment makers could avoid developing their own interfaces or being locked into a supplier’s proprietary design. Judged in those terms, MSAs have been a roaring success. Equipment makers can now buy optical int erfaces from several sources, all battling for the design win. MSAs have also triggered a near-decade of innovation, resulting in form factors from the 300-pin large form factor transponder MSA to the pluggable SFP+, less than a 60th its size.

erfaces from several sources, all battling for the design win. MSAs have also triggered a near-decade of innovation, resulting in form factors from the 300-pin large form factor transponder MSA to the pluggable SFP+, less than a 60th its size.

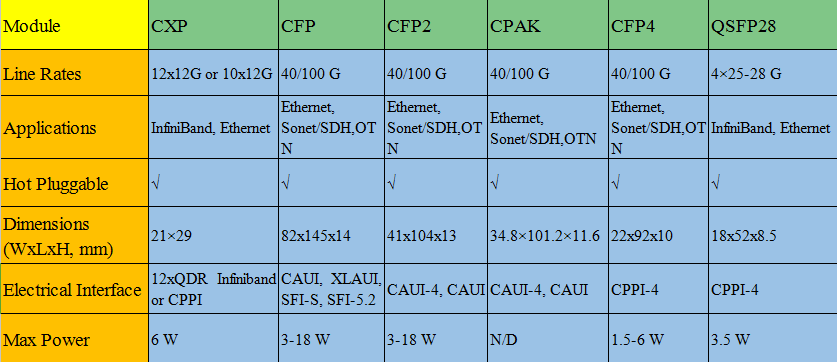

But MSAs, with their dictated size and electrical interfaces, are earmarked for specific sectors. As such the protocols, line rates, and distances they support are largely predefined. Little scope, then, for differentiation. Yet vendors have developed ways to stand out. One approach is to be a founding member of an MSA. This gives the inner circle of vendors a time-to-market advantage in securing customers for emerging standards. The CFP MSA for 40- and 100-Gigabit Ethernet is one such example.

Some designs required specialist optical components that only a few vendors have, such as high-speed VCSELs used for the latest Fibre Channel interfaces. In turn, many vendors don’t have the resources—design teams and the deep pockets—needed to develop advanced technologies, such as those for 40- and 100-Gbps transponders, whether it is integrated optical devices or integrated circuits.

Being the first to integrate existing designs into smaller form factors is another way to differentiate oneself. An example is JDSU, which has integrated a tunable laser into the pluggable XFP MSA. Fiberstore also then launched tunable XFP which features with tunable and multi-protocol functions in order to further expand the product lineup of the 10G optical transceiver modules.

Optical transceiver vendors are also differentiating their products through marketing approaches. New-entrant Far Eastern vendors are selling optical transceivers directly to service providers and data center operators, bypassing equipment makers. They are also looking to differentiate on price, cutting costs where they can (including R&D) and focusing on bread-and-butter designs. They are quite happy to leave the leading vendors to make the heavy investments and battle each other in the emerging 40- and 100-Gbps markets.

Some people think differentiation doesn’t matter so much for optical transceivers since even if a vendor gets a lead, others inevitable will follow. And anyway, the cost of transporting traffic is still too high even with the fierce competition instigated by MSAs. In turn, optical transceivers are now a permanent industry fixture and they can’t be conjured to disappear.

with the fierce competition instigated by MSAs. In turn, optical transceivers are now a permanent industry fixture and they can’t be conjured to disappear.

For optical transceiver vendors, however, the result is a market that is brutal. So can optical transceiver vendors differentiate their products? Of course they can. FS.COM (Fiberstore), a company devoting on the research & development, and offering fiber connectivity network solutions for carriers, ISPs, content providers and networks, is the global market innovator and application technology pioneer in the field of optical network devices and interconnection. In the future, they seem to change this market.